Automating Sustainability Reporting with Gprnt

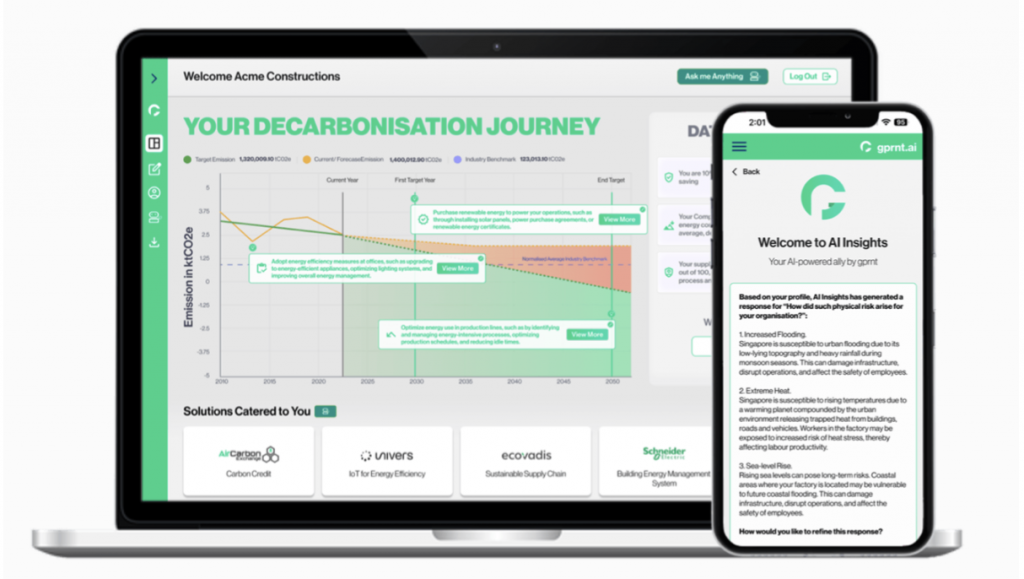

By ESG Analyst Taran Franck Screenshot from Gprnt.ai Context As ESG reporting in most lead economies has become more sophisticated and widely enforced, inconsistent standards in the Asia-Pacific (APAC) region have enabled many of its companies to fall short of standards. According to the latest Task Force on Climate-related Financial Disclosures (TCFD) Report, only 57% …