By ESG Analyst Taran Franck

Screenshot from Gprnt.ai

Context

As ESG reporting in most lead economies has become more sophisticated and widely enforced, inconsistent standards in the Asia-Pacific (APAC) region have enabled many of its companies to fall short of standards. According to the latest Task Force on Climate-related Financial Disclosures (TCFD) Report, only 57% of large APAC companies disclosed their climate-related targets compared to 92% of European peers. In an effort to close this gap, the Monetary Authority of Singapore (MAS) launched the Gprnt (pronounced “Greenprint”) platform in November 2023 to help companies automate their sustainability reporting processes. The launch created a new public-private partnership between MAS and corporate entities in private banking and tech sectors including HSBC, KPMG Singapore, Microsoft, and MUFG Bank as strategic partners.

What is Gprnt?

Gprnt represents the final product of MAS’ Project Greenprint in an AI-powered platform providing tailored digital ESG reporting solutions for large businesses and small and medium enterprises (SMEs).

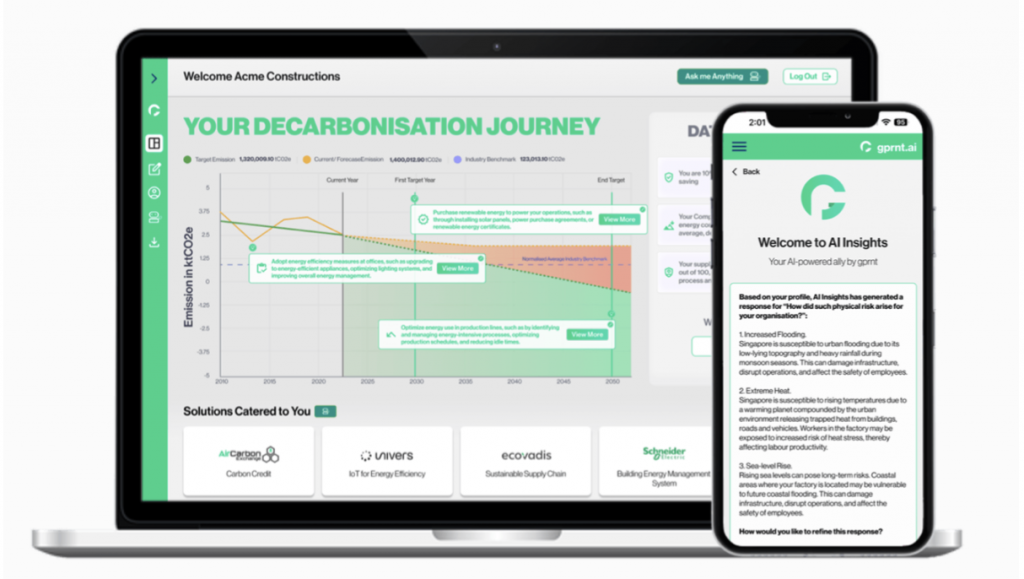

Figure 1: Visualisation of Gprnt platform

The main features of Gprnt’s digital platform are:

The primary feature is the disclosure portal. On the portal, companies choose from different ready-made sustainability packages that match global standards (GRI, TCFD, ISSB, etc.). The Gprnt algorithm then identifies areas of improvement and prompts qualitative questions about ESG risks. Where there are knowledge gaps, companies can access ESG educational resources and recommendations via the platform. Additionally, the platform detects ESG trends and helps companies benchmark themselves against peers. The second component is the Gprnt Registry, which grants companies access to the comprehensive database that aggregates all ESG data. The final feature is the Gprnt marketplace, a collaborative edge to the product which enables companies to connect with other ESG fintech companies, ESG solution providers, investors, financial institutions, and corporations.

Key benefits of Gprnt:

Automated ESG Data Collection: Gprnt will streamline the collection and interpretation of climate and sustainability data by integrating with a range of digital systems that businesses typically use in their day-to-day activities such as utilities consumption, bookkeeping and payroll systems, payments gateways, and networks for artificial intelligence of things (AIoT) sensors and devices. These integrations allow for scattered data to be streamlined on the Gprnt platform to facilitate the automatic calculation of sustainability metrics.

Seamless ESG Data Computation: Gprnt will translate and interpret this data into ESG-related outputs for businesses to report. The platform will then compare these sustainability metrics with major international reporting standards such as the Global Reporting Initiative (GRI), Task Force on Climate-related Financial Disclosures (TCFD) framework and the International Sustainability Standards Board (ISSB) standards. Powered by Microsoft Azure’s OpenAI GPT4 model, it will then automatically generate basic sustainability reports.

Autonomous Data Management: Once the data has been translated into an ESG output, it is at the business’ discretion to decide with whom to relay that information that best serves their interests. Many have leveraged the output to obtain green loans from banks, and other companies to access green opportunities, and to collaborate with government or international platforms such as Net Zero Data Public Utility (NZDPU), for their reporting needs.

Support for SMEs: Gprnt tackles the problems SMEs experience at the start of their sustainability reporting journeys. Generally, ESG reporting for SMEs is costly and time-consuming. Furthermore, the built-in consultation with government agencies like the Accounting and Corporate Regulatory Authority (ACRA), the Enterprise Singapore, and the Infocomm Media Development Authority (IMDA) provides a seamless solution to more efficiently meet the reporting needs of SMEs.

Gprnt’s Status in 2024

Gprnt is currently live beta-testing with selected banks and SMEs. Moving forward, a newly created for-profit entity called Greenprint Technologies Pte Ltd will manage the platform, progressively scaling Gprnt’s capabilities and network of data sources to serve the more advanced needs of larger multinational corporations, financial institutions, supply chain players, and national authorities.

“With reliable ESG data being a critical component for sustainable finance, a platform like Gprnt will be a useful tool for the financial industry and may serve as an impetus to the growth of sustainable financing in Singapore and across the region. Transitioning to net zero requires both the public and private sectors to explore and co-create innovative solutions. We are excited to collaborate in this initiative and to provide our global expertise and knowledge to support corporates in their sustainability journeys.” – Mr. Barry O’Byrne, CEO of Global Commercial Banking @ HSBC

“The Gprnt platform is absolutely pivotal to spearheading a transformation in sustainability within the region. By actively gathering and transforming SME ESG data, we will not only enhance transparency within private markets but also catalyse corporate efforts in reducing their environmental impact, safeguarding vulnerable communities and jobs. At KPMG, we are fully committed to applying our advisory and venture building expertise to champion Gprnt at every stage of its evolution, towards becoming an industry-leading ESG fintech platform.” – Mr. John McCalla-Leacy, Head of Global ESG, KPMG International

“As one of the founding members of Gprnt.ai, we are excited by the MAS’ initiative to integrate intelligent technologies with trusted data, underpinned by solid policy support, to accelerate a just transition to a sustainable economy. This venture simplifies ESG reporting for companies across supply chains and sectors in support of their sustainability requirements. For MUFG, it also offers another crucial platform for dialogue and collaboration, where we hope to contribute to enhancements around ESG governance and reporting while unlocking further investment and capital for global decarbonization.” – Mr. Masakazu Osawa, Chief Executive for Asia Pacific, MUFG Bank

“Microsoft is thrilled to partner with Greenprint, utilising our Microsoft Cloud for Sustainability and AI capabilities to power this transformative initiative. Together, we are committed to foster smarter and more effective methods to advance sustainable finance, aligning with our joint ambition of a greener future.” – Ms. Shelly Blackburn, Vice President of Sustainability & New Motions, Microsoft

References:

- Chakraborty, Ranamita. “MAS’ Gprnt May Offer ESG Data Blueprint.” ESG Investor, February 19, 2024. https://www.esginvestor.net/mas-gprnt-may-offer-esg-data-blueprint/.

- “Gprnt.Ai.” gprnt.ai. Accessed February 26, 2024. https://www.gprnt.ai/.

- Huang, Claire. “Singapore Sets up New Platform in Green Data Ecosystem.” The Straits Times, November 16, 2023. https://www.straitstimes.com/business/singapore-sets-up-new-platform-in-green-data-ecosystem.

- LLP, Latham & Watkins. “Singapore Establishes New Platform for ESG Data.” Environment, Land & Resources, January 29, 2024. https://www.globalelr.com/2023/11/singapore-establishes-new-platform-for-esg-data/#:~:text=In%20December%202020%2C%20the%20Monetary,green%20finance%20in%20the%20region.

- “MAS Launches Gprnt Digital Platform for ESG Reporting for SMEs.” MAS launches GPRNT digital platform for ESG reporting for smes. Accessed February 26, 2024. https://www.moodysanalytics.com/regulatory-news/nov-29-23-mas-launches-gprnt-digital-platform-for-esg-reporting-for-smes.

- Monetary Authority of Singapore (MAS). “MAS Launches Digital Platform for Seamless ESG Data Collection and Access.” Maintenance. Accessed February 26, 2024. https://www.mas.gov.sg/news/media-releases/2023/mas-launches-digital-platform-for-seamless-esg-data-collection-and-access.

- Novisto. “The Risks of Low-Quality ESG Data.” Novisto, November 14, 2023. https://novisto.com/the-risks-of-low-quality-esg-data/.

- Singh, Ishan, Sade Dayangku, Yoganeetha Sivakumar, Jayme Teo, Partnered Post | Claudia Khaw, and Claudia Khaw. “Building Gprnt.Ai: Mas Works with Microsoft, HSBC, KPMG, to Simplify ESG Reporting.” Vulcan Post, November 29, 2023. https://vulcanpost.com/846573/mas-gprnt-ai-simplify-esg-reporting/.

- Task Force on Climate-related Financial Disclosures. Rep. Task Force on Climate-Related Financial Disclosures 2023 Status Report. Task Force on Climate-related Financial Disclosures , 2023.

- Unveiling of MAS’ Gprnt (greenprint) digital platform that makes … Accessed February 26, 2024. https://dollarsandsense.sg/unveiling-mas-gprnt-greenprint-digital-platform-esg-businesses/.