By ESG Analyst Jonah Leduc

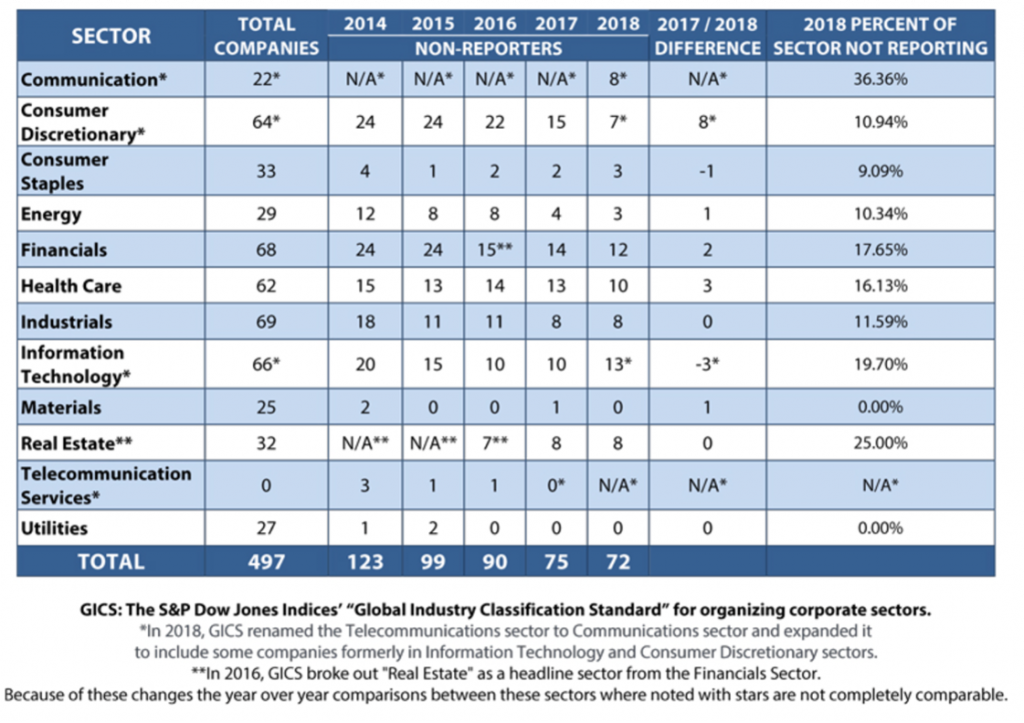

The lack of convergence across companies and geographies on ranking Environmental, Social, and Governance (ESG) impacts has posed a significant challenge within sustainable investing and corporate reporting. Notably, over the last several years, sustainability and ESG practices have integrated deeper into the corporate reporting landscape and have become a requirement across companies seeking to impress investors and evade regulators. US public companies have faced increasing pressure from investors and other stakeholders to disclose their ESG risks, practices and impacts, with over 86% of S&P 500 companies publishing annual sustainability reports and other ESG disclosures (Governance and Accountability Institute, 2019) (figure 1).

However, with an abundance of new reports being published across companies among industries and geographies – regulators, individuals, and investors alike have expressed their concerns about a standardized ESG disclosure framework, which makes it difficult for investors to evaluate and compare companies’ ESG practices and risks meaningfully, ultimately reducing the value of such disclosures. This results in more companies being pressured to report, and consequently, the boards and directives need more centralization, transparency and standardization. For example, below outline a few of the global entities involved in influencing the ESG reporting guidelines:

- Global Reporting Initiative (GRI): GRI is one of the most widely used frameworks for ESG reporting. It provides guidelines for reporting on a wide range of sustainability topics.

- Sustainability Accounting Standards Board (SASB): SASB focuses on industry-specific standards for reporting financial material sustainability information.

- Task Force on Climate-Related Financial Disclosures (TCFD): TCFD provides recommendations for disclosing climate-related financial risks and opportunities.

- International Integrated Reporting Council (IIRC): IIRC promotes integrated reporting, which combines financial and non-financial information, including ESG factors, to provide a more comprehensive view of a company’s performance.

- Carbon Disclosure Project (CDP): CDP is a global platform for companies to disclose their environmental impacts, including carbon emissions.

- UN Sustainable Development Goals (SDGs): Some companies align their ESG reporting with the United Nations’ 17 Sustainable Development Goals to show how they contribute to global sustainability objectives.

Evidently, with so many different regulatory bodies and frameworks – it appears inconceivable for the world’s largest companies to coherently standardize their reporting metrics across countries and industries. And even in doing so, unlike financial statements, there is no restriction on who can assure the voluntary ESG data. The SEC has contemplated allowing firms other than accounting firms to provide assurance, such that emerging renewable energy and engineering firms, for example, could assure climate change disclosures. A study of 818 US companies reported that 57 percent of engagements were conducted by audit firms in 2021, a decrease from 61% in 2019 (Thomspon Reuters, 2023). With independent energy transition firms and technology companies assuring the ESG impacts of global companies, this credibility divergence will only grow. There needs to be a greater effort in the standardization process between reporting guidelines, assurance enforcers, and the regulatory bodies that oversee these corporations.

Impacts

Thus, this issue on ESG, particularly sustainability targets for individuals, companies and governments, will only be achieved if they can be tracked appropriately. These issues matter primarily for three reasons. Greenwashing, widening the discrepancy between ESG performance and financial returns, and government abilities to bring about change. Particularly:

- Greenwashing: this term refers to the practice of making false or misleading claims about a company’s environmental or social responsibility efforts. With the need for standardized ESG reporting, some companies may exaggerate their positive ESG attributes while downplaying negative impacts, making it challenging for investors and consumers to distinguish between genuinely sustainable practices and marketing tactics. Volkswagen was recently caught overstating their ESG performance and was required to recall millions of cars worldwide and has set aside €6.7bn (£4.8bn) to cover costs. That resulted in the company posting its first quarterly loss for 15 years of €2.5bn in late October. The expenses of Greenwashing can punish key societal stakeholders, the environment, and companies themselves.

- Difficulty in Monitoring ESG Performance for Financial Returns: Investors are increasingly interested in integrating ESG considerations into their investment strategies. However, with standardized ESG metrics, assessing ESG factors’ financial impact is easier. Investors may need help determining which ESG factors are most material to financial performance. This will ultimately risk less capital being deployed to companies with truly strong ESG reporting standards and targets, and thus, economic and market forces will slow efforts for positive change.

- Hindering political solutions to net zero: Government policies regarding taxation, fines, and infrastructure development are now principally designed with the effort to decarbonize their economy and transition to net zero. With standardized ESG reporting, government agencies may be able to collect consistent and reliable data on the environmental impact of companies and industries. This inconsistency can make it challenging to set baseline emissions targets, monitor progress, and enforce regulations effectively. Additionally, with standardized benchmarks, governments may find it easier to identify top performers and laggards regarding emissions reduction, which is essential for setting industry-specific targets and incentives. Thus, consistent and centralized ESG frameworks will help in the political sphere by helping form consistent and bespoke policies to address the most significant sources of emissions or allocate resources efficiently.

Solutions

While this report has only disclosed the problems with today’s reporting standards, key players are initiating momentum for change. One critical development in the US is the trend of institutional investors, which collectively hold average stakes of more than 20% in S&P 500 companies, issuing their own guidelines supporting SASB or TCFD standards. For example:

- BlackRock has requested that the companies they invest to, by year-end 2020, (1) publish disclosure in line with industry-specific SASB guidelines and (2) disclose climate-related risks in line with the TCFD’s recommendations. BlackRock will deem a failure to comply to signal that the company is not adequately managing ESG risk.

- In 2019, State Street launched its R-Factor score, an ESG evaluation system based on the SASB framework. State Street has indicated that beginning in 2020, it will “take appropriate voting action against board members at companies in the S&P 500, FTSE 350, ASX 100, TOPIX 100, DAX 30 and CAC 40 indices that are laggards based on their R-Factor scores and that cannot articulate how they plan to improve their score.”

- Vanguard has publicly encouraged companies to use standardized frameworks and notes the value of the SASB framework generally and the TCFD approach concerning climate-related disclosures.

On the assurance side of things:

- The International Financial Reporting Standards Foundation is developing a global ESG standard.

- The World Economic Forum is collaborating with the ‘Big 4’ accounting firms to establish ESG reporting metrics and disclosure standards.

- The International Organization of Securities Commissions is working to support convergence among securities regulators.

Thus, as this issue has become apparent in recent years, so have the efforts to solve them; these “distinct” governing bodies and frameworks have amplified their convergence initiatives to ultimately structure clear, transparent and applicable ESG reporting guidelines across geographies, industries and financial markets. Providing such transparent and coordinated regulations and saying framework comes with benefits, including government transition goals, greenwashing and the financial return profile of ESG-positive companies. This standardized system of ESG metrics will help create alignment in the effort to build more sustainable companies across all industries. As companies and regulators focus on publishing robust ESG strategy and reporting, countries can strengthen their narrative on the journey toward long-term value and sustainability.

References:

Bolden, Kyle. “Aligning Nonfinancial Reporting with Your ESG Strategy to Communicate Long-Term Value.” Aligning Non-Financial Reporting & ESG Strategy | EY Canada, EY, 18 Dec. 2020, www.ey.com/en_ca/real-estate-hospitality-construction/aligning-nonfinancial-reporting-with-your-esg-strategy-to-communicate-long-term-value?WT.mc_id=10921483&AA.tsrc=paidsearch&gad=1&gclid=CjwKCAjwyNSoBhA9EiwA5aYlbzEAuPBgMK6vNlrHDZ9H4Kvt0iSE6-huABvj9On1wyLpDZGoKxseMBoCK4gQAvD_BwE&gclsrc=aw.ds.

Clarkin, Catherine, et al. “The Rise of Standardized ESG Disclosure Frameworks in the United States.” The Harvard Law School Forum on Corporate Governance, 22 June 2020, corpgov.law.harvard.edu/2020/06/22/the-rise-of-standardized-esg-disclosure-frameworks-in-the-united-states/.

Conmy, Stephen. “10 ESG Trends to Watch in the Coming Years.” The Corporate Governance Institute, 13 Apr. 2023, www.thecorporategovernanceinstitute.com/insights/guides/10-esg-trends-to-watch/.

Electric, Schneider. “Trends & Challenges with Standardizing Corporate ESG Disclosures.” GRESB, 4 Apr. 2022, www.gresb.com/nl-en/trends-challenges-with-standardizing-corporate-esg-disclosures/.

Ho, Soyoung. “Nearly All Large Global Companies Disclose ESG Information.” Thomson Reuters Tax & Accounting News, 1 Mar. 2023, tax.thomsonreuters.com/news/nearly-all-large-global-companies-disclose-esg-information/#:~:text=The%20study%20found%20that%2057,63%20percent%20by%20audit%20firms.

Hotten, Russell. “Volkswagen: The Scandal Explained.” BBC News, BBC, 10 Dec. 2015, www.bbc.com/news/business-34324772.

“Navigating the Way to Sustainability.” Governance and Accountability Institute Inc., www.ga-institute.com/storage/press-releases/article/flash-report-86-of-sp-500-indexR-companies-publish-sustainability-responsibility-reports-in-20.html. Accessed 1 Oct. 2023.