By ESG Analyst Jonah Leduc

Within sustainable finance, green bonds and sustainable debt instruments have emerged as powerful tools for channeling capital toward environmental and social projects. Their rise signifies a shift in the financial landscape, where investment decisions are becoming influenced by considerations of sustainability and social impact in alignment with financial returns. Today’s newsletter will discuss three pivotal aspects of this trend: the growth of the green bond market, the diversification of sustainable debt instruments, and the role of regulatory frameworks and standards in ensuring their transparency and integrity.

1. The Meteoric Rise of the Green Bond Market

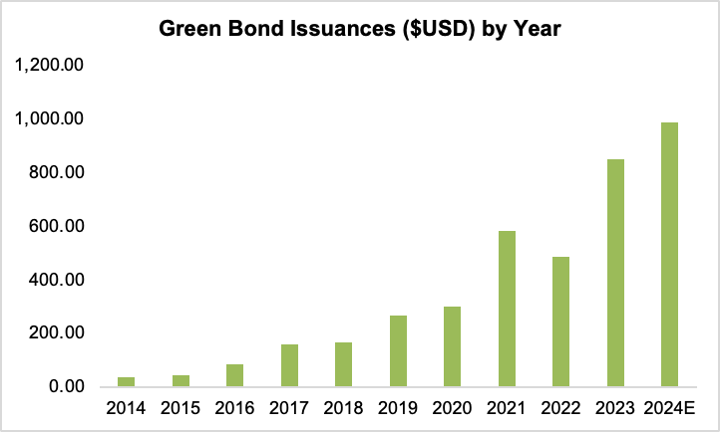

The green bond market has witnessed exponential growth since the issuance of the first green bond by the European Investment Bank in 2007. From a modest beginning, the market has burgeoned, with the issuance of green bonds reaching a record high of $269.5 billion in 2020. This surge reflects a growing recognition among investors of the importance of environmental sustainability and their increasing demand for investment opportunities that align with their values. Green bonds have become a favoured instrument for financing an array of environmental projects, including renewable energy generation, energy efficiency improvements, sustainable transportation, and water management. The success of green bonds has not only mobilized significant financial resources for these projects but has also set a precedent for the integration of environmental considerations into mainstream financial decision-making. The green bond market has not only experienced remarkable growth in the past decade but is also poised for continued expansion in the coming years. Analysts predict that the issuance of green bonds is set to reach new heights, with projections suggesting that the market could exceed $1 trillion in annual issuances by 2024 and $5 trillion by 20301. The focus on financing adaptation and resilience to climate change is expected to grow, particularly in green and sustainability use-of-proceeds bonds. This is in response to the need for more investment in adaptation and resilience highlighted at COP27. The public sector is expected to lead in financing these areas, but there are signs that the private sector is increasingly recognizing the importance of adaptation and resilience. Overall, the green bond market is expected to continue its rapidly expanding number of issuances, driven by supportive policies, laws, regulations, and transparency initiatives. The evolving regulatory landscape, such as the EU Green Bond Standard, is expected to further drive issuance by providing a framework for issuers to align with and ensuring that green bonds finance projects with genuine environmental benefits.

Source: https://www.statista.com/statistics/1289406/green-bonds-issued-worldwide/

2. Diversification of Sustainable Debt Instruments

The success of green bonds has paved the way for the development of a broader number of sustainable debt instruments, each tailored to address specific environmental or social challenges. Sustainability bonds, for example, offer a more flexible framework, allowing issuers to finance a combination of green and social projects. This versatility makes them particularly appealing to organizations looking to address multiple sustainability objectives simultaneously. Social bonds have also gained traction as a tool for funding projects with direct social benefits, such as affordable housing, education, and healthcare. The COVID-19 pandemic has further highlighted the importance of these bonds, as governments and institutions seek to address the social and economic fallout of the crisis. Additionally, as the market expands, the scope of projects financed by green and other ESG-related bonds is expected to broaden and evolve. While traditional areas such as renewable energy and energy efficiency will continue to be significant, new sectors are emerging as critical components of the green finance landscape2:

- Climate Change Adaptation: As the impacts of climate change become more pronounced, a growing portion of green bond proceeds is likely to be allocated to adaptation projects. These may include infrastructure enhancements to withstand extreme weather events, investments in resilient agricultural practices, and initiatives to protect coastal communities from rising sea levels.

- Sustainable Transportation: The transition to low-carbon transportation is a key element of global efforts to reduce greenhouse gas emissions. Green bonds are expected to play a crucial role in financing the development of electric vehicle infrastructure, public transit systems, and other sustainable transportation solutions.

- Biodiversity Conservation: The preservation of natural ecosystems and biodiversity is gaining attention as a critical environmental objective. Green bonds could increasingly be used to fund projects that protect and restore forests, wetlands, and other vital habitats.

- Circular Economy: The shift towards a circular economy, where waste is minimized, and resources are reused and recycled, is another area that green bonds are likely to support. Financing could be directed towards initiatives that promote recycling, sustainable materials, and waste reduction technologies.

- Sustainable Agriculture: As the need for sustainable food systems becomes more pressing, green bonds could fund projects that promote organic farming, water-efficient irrigation, and other practices that reduce the environmental footprint of agriculture.

3. The Crucial Role of Standards and Regulation

The integrity and credibility of green and sustainable bonds are underpinned by a robust framework of standards and regulations. The Green Bond Principles, established by the International Capital Market Association, provide voluntary guidelines on transparency, disclosure, and project selection, ensuring that funds raised are allocated to genuinely green projects. Regulatory bodies around the world are increasingly recognizing the importance of these instruments in achieving environmental and social goals. Initiatives such as the European Union’s Sustainable Finance Taxonomy and the development of national green bond standards aim to provide clarity and consistency, fostering investor confidence and facilitating the growth of the market. Moreover, third-party verification and certification schemes, such as the Climate Bonds Standard, play a crucial role in assuring investors of the environmental impact of their investments. Among other national issuance standards, the credibility of the green bond market is upheld by a robust framework of standards and regulations, which are essential for maintaining investor confidence and preventing greenwashing, including:

- Green Bond Principles (GBP)3: Established by the International Capital Market Association (ICMA), the GBP provides voluntary guidelines on transparency, disclosure, and project selection for green bonds. They outline best practices for reporting and external review, ensuring that proceeds are allocated to legitimate green projects. As of 2023, the GBP has been widely adopted by issuers and endorsed by investors, contributing to the harmonization of practices in the green bond market.

- EU Green Bond Standard (EU GBS)4: The European Union has been working on a voluntary Green Bond Standard, which aims to provide a high-quality label for green bonds issued in the EU. The standard is expected to be aligned with the EU Taxonomy Regulation, ensuring that financed projects contribute to environmental objectives such as climate change mitigation and adaptation. The adoption of the EU GBS is anticipated to enhance transparency and consistency in the green bond market, although its impact on issuance may be limited in the short term due to stringent criteria and data availability challenges.

- Climate Bonds Standard5: Developed by the Climate Bonds Initiative, this certification scheme provides a rigorous screening process for green bonds, ensuring that they align with the Paris Agreement’s goals. Certified bonds must meet sector-specific criteria that demonstrate a clear contribution to climate change mitigation or adaptation. The Climate Bonds Standard has gained recognition as a credible tool for issuers to demonstrate their commitment to environmental integrity.

These measures are essential in maintaining the integrity of the market and preventing “greenwashing,” where projects are falsely presented as environmentally friendly.

Ultimately, Green bonds and sustainable debt instruments represent a dynamic and rapidly evolving segment of the financial market. Their growth reflects a broader shift toward sustainability in the investment world, driven by increasing environmental awareness and a growing recognition of the financial risks associated with climate change. As the market continues to mature, the development of robust standards and regulatory frameworks will be crucial in ensuring that these instruments fulfill their potential as catalysts for a more sustainable and equitable future.

References:

- Yen, A., Devevey, F., & Volland, E. (2023, September 5). S&P Global Homepage. S&P Global Homepage | S&P Global. https://www.spglobal.com/en/

- Bos, B. (2023, February 13). Understanding Green Bonds. Goldman Sachs Asset Management. https://www.gsam.com/responsible-investing/en-INT/professional/insights/articles/understanding-green-bonds

- Green bond principles (GBP). Green Bond Principles ” ICMA. (2022, June). https://www.icmagroup.org/sustainable-finance/the-principles-guidelines-andhandbooks/green-bond-principles-gbp/

- The European Green Bond Standard – supporting the transition. European Commission. (n.d.). https://finance.ec.europa.eu/sustainable-finance/tools-and-standards/european green-bond-standard-supporting-transition_en

- Climate bonds standard v4.0. Climate Bonds Initiative. (2024, March 12). https://www.climatebonds.net/climate-bonds-standard-v4