By ESG Analyst Clara Coeudevez

This article features content from an interview with Phil Donelson, Director of Catastrophic Risk & Climate Policy at the Insurance Bureau of Canada.

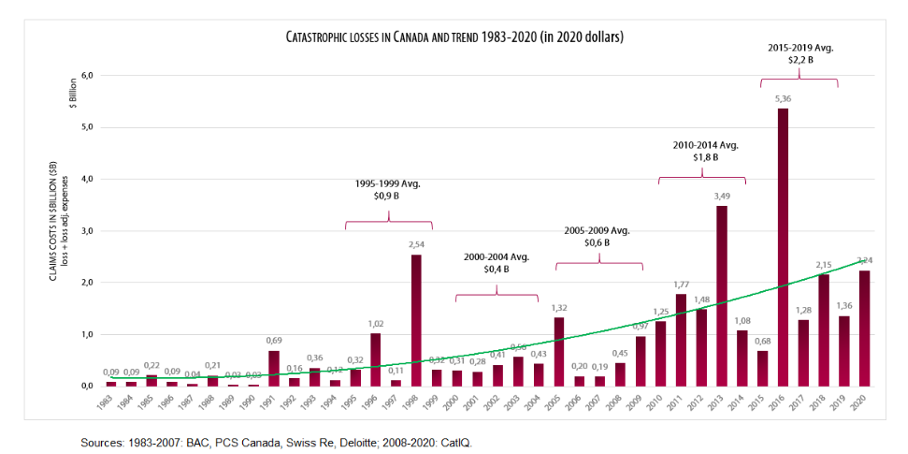

In Canada, insured damage for severe weather events reached over $3.1 billion in 2023, according to Catastrophe Indices and Quantification Inc, making it the fourth-worst year for insured losses in Canada. This number does not make 2023 an anomaly, but rather the expected unfolding of a trend that has been observed in the last 10 to 15 years.

Physical risks have always been a part of the insurance industry, whether characterized as climate risks or not in the past. This trend has been accelerating in the last 10-15 years, during which the insured losses from natural catastrophes (which are climate-related extreme weather events) have steadily increased. For the last 2 years, they have been over 3 billion dollars, just for insured losses for natural catastrophes, not accounting for the entire losses. This has a lot of implications from an insurance perspective, and an issue that has emerged is the cost and availability of insurance for people who live in very high-risk areas, especially for flooding.

Floods and wildfires are the most common physical risks in Canada, and they both continue to grow, year over year. Other risks that can be mentioned are hailstorms in Calgary, hurricanes on the East coast and earthquakes in British Columbia, the St Lawrence River and the Ottawa River Valley. These catastrophes impact homes and infrastructures.

Despite flooding being a prominent physical risk for Canadian homeowners, only over the last ten years has there been insurance in Canada for over-land flooding (from rainfall of overland flooding, coastal storm surge). Wildfires have been the cornerstone of a homeowners insurance policy since the industry was created, and therefore have always been covered. In comparison, the risk modelling and mapping for over-land flooding got more sophisticated and accurate over time, so those coverages were able to grow.

Risk Modelling and Data Sharing

Risk modelling in the insurance industry is a collective effort. There are third-party companies that create models (for example AIR Worldwide) for different kinds of risks. Over time, they do better mapping and use more sophisticated inputs and data to update their maps, which are then used by insurance companies. Often insurance companies also have their own maps, but they always also use maps by third-party companies. As the risk itself is increasing and as there is a better understanding of that risk, then it has implications on the cost of insurance. Insurance is all about pricing risks, the better the sense of the probability of a risk is, the more accurate pricing is. The overall trend is that models are getting better, and more precise and grant a better understanding of when the events are going to happen.

The governments also complete and share their own mapping, which is really helpful for all types of actors. The federal government is also updating a federal flood map, and they are building a tool for consumers called the flood portal. The idea is that citizens can go to the website, enter their home address, and have a good sense of the risk of flooding for their homes. These initiatives are important because they empower consumers to have a better understanding and level of education of their risks. NGOs can use this tool to help educate people, and the Canadian Red Cross for example also benefits from this shared data. There is a general move for better-shared data, more openly and transparently with as many people as possible.

How to Insure the Highest Risks and Public-Private Partnerships

In recent years, big natural catastrophe losses have been observed in the financial statements of insurers. The economic resiliency and the pertinence of the business models are threatened. Because flooding is a prevalent physical risk in Canada, let’s explore this example to understand a solution to insuring risks so high they become a regular occurrence.

As the over-land floods insurance market has evolved over time, it has been quite successful overall, but there has been a protection gap that has emerged for the top 10% of at-risk properties in Canada. This happens when the risk is so high that the cost of insurance becomes unaffordable. The result is that these products are not offered in the at-risk areas. There is a section of people at the highest risk levels who do not have access to flood insurance in an affordable way. So, the Insurance Bureau of Canada has been working with the government on a national flood insurance program that would focus on this issue. The program is targeting those people, to make sure they have insurance instead of relying on disaster aid after a big event happens. Because it is less convenient to get money to people after the fact, the point is to get them proper insurance, that is subsidized to make it affordable. To fund this program, the proposition is to use some of the money that is currently being spent on disaster aid and instead direct it to an insurance framework that people can afford and that protects them ahead of time. It would be a comprehensive product, available to everybody in the top 10% of risk, no matter which insurers they work with.

When these protection gaps emerge and the risk gets simply too high, then there is room for public-private partnership, so the industry can step up and handle all the claims but need the government to back up programs and subsidize products to people, making sure they can actually afford it.

Such an insurance framework is useful, but a more comprehensive approach needs to involve a climate-resilient infrastructure investment plan and better land-use planning. A housing shortage is currently observed in Canada, and a lot of homes need to be built, climate resiliency means being mindful of where these projects will be conducted and avoiding flood places, so the problem does not get worse. There needs to be complimentary policies that will effectively reduce the risks over time.

Governmental Actions

Some programs by the government subsidize climate-resilient retrofits, in the form of credit by the federal government for citizens who want to take protective actions for their homes. Depending on the insurers, discounts can be offered if one is taking steps and investing to protect their home from certain risks. In terms of public understanding of the risks, insurance brokers are key partners, they do a great job of explaining to someone the risk they have based on their modelling, and the appropriate level of insurance they may need.

The Insurance Bureau of Canada worked with the government on the National flood insurance program. What they are asking for is for this year’s federal budget to include the funding for a national flood insurance program. At the moment, the focus is on the federal level, trying to get funding for it in this year’s budget.

When working with the government on such issues, the IBC is in touch with Public Safety Canada, Canada Mortgage and Housing Corporation (involved in the flood program design), Finance Canada (for the funding), Environment and Climate Change Canada, and InterCanada (mapping). The collaborations happen in the form of government-launched task forces, or structured consultation, during which actors in the industry get involved in the policy development process. For the task force on flood insurance reallocation, there was a provincial group, a federal government internal group and an industry group, that was led by the IBC. Those groups were coming up with different design options, solutions for the flood insurance program, what it could look like, as well as comparing with other jurisdictions’ solutions. Those formal consultations are a great way for the industry, academia, NGOs, and others to be involved and give the best advice possible to the government.

With the provincial government, IBC’s big focus is on land use planning. Building houses in proper places, understanding climate risk in that way and infrastructure investments, that are shared with the federal government. They are trying to educate, making sure that climate resiliency is taken into account with any new infrastructure project and bringing forward the best possible advice from academics and industry experts.

Climate Change: A Driving Force for the Industry

Insurance companies have been at the forefront of climate change for a long time because of their pricing risk, which makes them sensitive to climate-related catastrophes and increases awareness in the industry. The Insurance Bureau of Canada, and other actors of the industry, have been alarming the government for a long time on the climate resiliency aspect. In terms of fighting climate change itself, there is a move for better disclosures among financial institutions, of emissions and climate risk management, for example with the TCFD framework. It is important to mention guideline B-15, which sets out a timeline for financial institutions, including insurance companies, to show how they are managing climate risks, how they have proper internal governance and, more critically, disclose scopes 1, 2 and 3 emissions on an ongoing basis year after year. The tracking of these emissions by companies leads to concrete action to reduce them over time. Regarding the insurance industry, a recent report by the Office of the Superintendent of Financial Institutions (OSFI), which surveyed the Canadian financial organizations they regulate and asked them to do a self-assessment of their readiness to do this kind of disclosure, proved to be rather positive for insurers. They indeed seem to be ahead of most institutions when it comes to proper governance of climate risks, risk mitigation strategies, and split of emissions toward Net Zero.

Canada is becoming a riskier place due to climate change, this is seen across the country, in many different ways. It is critically important that governments make investments in climate resiliency and adaptation to make sure that homeowners are protected, that communities are making the right investments to protect themselves, and that insurers are taking the best scientific advice available to enable those protections. In the United States, there are a lot of protection gaps opening up, which is not yet the case in Canada, besides the flooding one. The industry, government, academia and NGOs, need to remain vigilant and work together, to make sure they are tackling these issues and sharing information as the situation evolves because Canada is becoming a riskier place and it is evolving quite rapidly year over year, so we need to make sure that we are making proactive decisions to protect people.

Phil Donelson is a seasoned leader and strategist in climate change, energy transition, and sustainable finance. Currently serving as Director of Climate & Catastrophic Risk at the Insurance Bureau of Canada, he leads strategy and research on sustainable finance and climate risk in the insurance industry. Previously, as Senior Advisor to the Premier of Ontario, he drove regulatory changes for renewables and carbon pricing.

The Insurance Bureau of Canada is the national industry association representing the vast majority of Canada’s P&C (property and casualty) insurers. Its major focus, when it comes to climate change, is on climate adaptation and resiliency.