By ESG Analyst Lars Tum

Canada is facing a severe and continuous housing crisis in which affordability has become unknown. While rental prices in Montreal are increasing at unprecedented levels, the median income of its citizens cannot afford to buy real estate in the city. An average income of $53,300 (2021) faces an average home price of $593,384 (September 2023).

“The secret of change is to focus all your energy not on fighting the old but on building the new.”

– Dan Millman

But as problematic and challenging as this might seem, it presents great opportunities for implementing ESG values in future housing projects and urban planning.

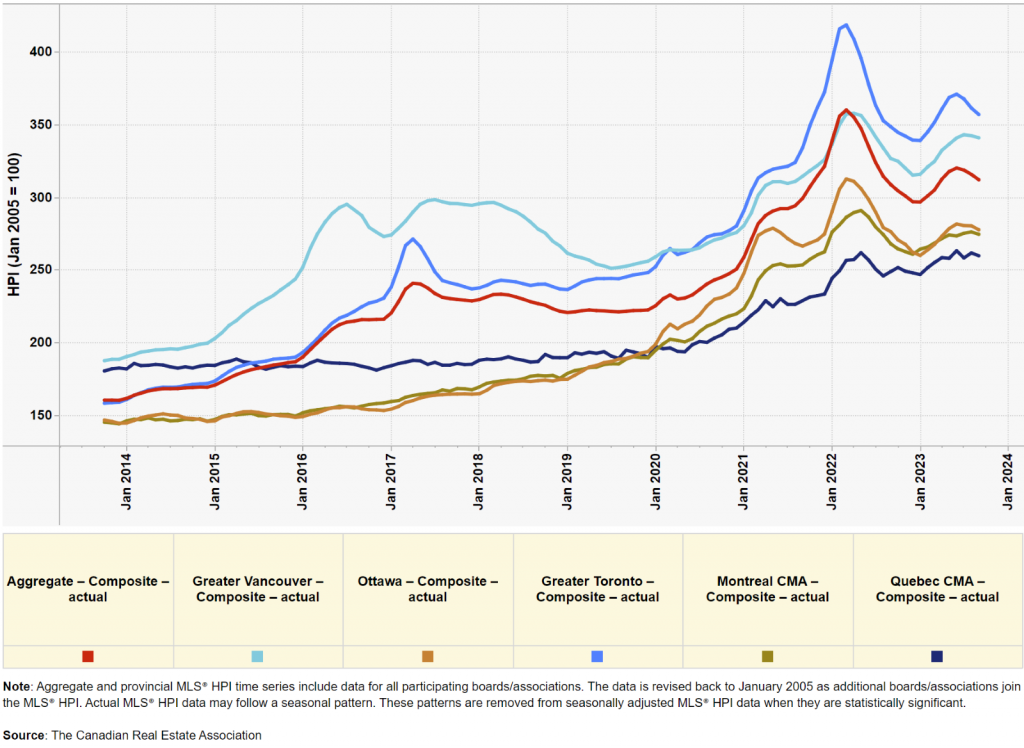

The housing crisis in Canada made its way into the House of Commons. This issue is, by a long shot, not only socioeconomic but also political since it affects most of the population. Apart from being instrumentalized in political clashes, it is also a real threat to Canadian citizens. The Home Price Index (HPI) serves as an indicator of the evolution of home prices. Compared to 2005 levels, Montreal’s house prices rose by 274.4 %. But other Canadian major cities suffer even more severely. Figure 1 shows that Greater Toronto with an increase of > 300 % compared to 2005 levels leads the chart of HPI in Canada.

Figure 1: Home Price Index (HPI) for major Canadian cities 2014-2024. Canadian Real Estate Association (CREA) (2023).

This high HPI could be a result or a lack of policies that led to too much demand while missing out on generating enough supply. The construction of residential housing in Montreal is at a historical low, while the population is consecutively increasing, mostly because of immigration.

Canada is now raising efforts by implementing a law to lower the impact of foreign real estate investors who are putting pressure on the already tense real estate market in Canada. Additionally, the Government of Canada introduced the Underused Housing Tax (UHT) to fight underused or vacant housing by non-Canadians. This Act is designed to release the pressure on Canadian citizens in the housing market as well as not targeting them in the real estate market. In addition to that, the Canada Mortgage and Housing Corporation (CMHC) introduced a Prohibition on the Purchase of Residential Property by Non-Canadians Act this year, to further prevent non-Canadians from buying residential property in Canada.

These measures could help boost the housing supply and consequently lower the pressure on the Canadian housing market. And this could open many pathways for ESG values to be implanted along the way. The Housing Accelerator Fund intends to fund the development of affordable, inclusive, equitable, and climate-resilient communities in populations of 10,000 or more. With this fund, local governments can be motivated to make more ESG-led decisions in the development of communities for Canadian citizens.

Government ESG frameworks to help investors construct social and sustainable cities and communities are a very valuable and non-intrusive approach to implementing ESG values using guidelines and funds. However, these frameworks should also be economically attractive for investors and must refrain from negatively influencing the construction of housing in areas where affordable housing is in a severe crisis.

Boutis, P. (2022): Affordable homes and healthy communities: How ESG values offer green solutions to the housing crisis. https://www.lexpert.ca/legal-insights/affordable-homes-and-healthy-communities-how-esg-values-offer-green-solutions-to-the-housing-crisis/365946

Raycraft, R. (2023): Federal government eases some restrictions on non-Canadians purchasing property. https://www.cbc.ca/news/politics/government-housing-ease-restrictions-non-canadians-1.6793247