By ESG McGill Analyst Henry Fowler

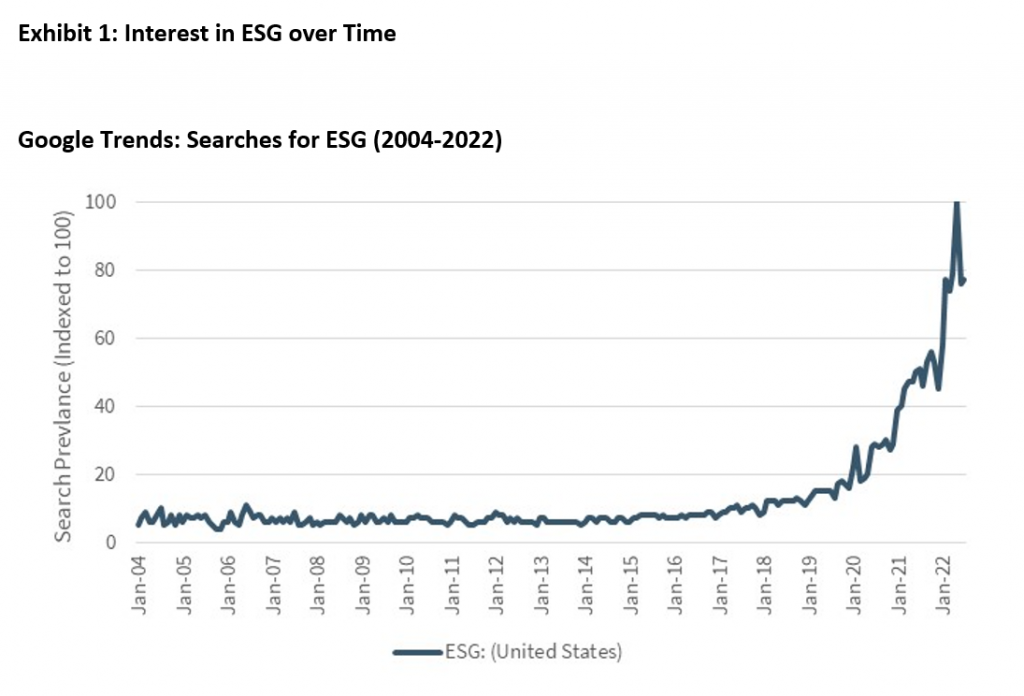

The 21st century has seen a significant shift in where companies, consumers, and other major stakeholders stand on Environmental, Social, and Governance (ESG) topics. Institutional investors and fund managers around the world are paying greater attention to sustainable activities in their operations in an attempt to address physical, liability, and transition risks caused by climate change. Even before the pandemic, a 2017 study found that 63% of respondents had increased their investments in companies with high ESG ratings, and 44% were even open to paying a premium for them. Now, in the post-pandemic world, ESG is more important than ever. There is greater consideration of companies’ ESG scores as investment assessment tools, which rank the sustainability of all business practices. In times of discontinuity, sustainability is more attractive than ever. Figure 1 displays the growth in ESG concern through the rise in internet searches.

Figure 1: Internet searches for ESG over time

An ESG score is a measurement of a company’s sustainability level. The calculation factors in many variables and produces a score ranging from 0–100. It takes into account everything from their environmental impact to human capital management. Commonly assessed aspects include resource efficiency, carbon impact, social benefits to stakeholders, diversity and inclusion initiatives, and the development of responsible business practices. ESG scoring has allowed investors to price in the unrepresented or unmeasured aspects of the company’s activities.

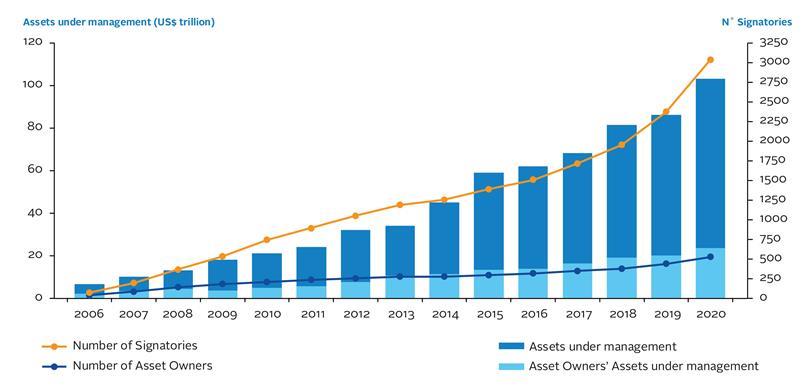

ESG investing is the practice of creating portfolios with sustainable companies. ESG investing began in the 1960s as socially responsible investing, with investors excluding stocks or entire industries from their portfolios based on business activities like tobacco production or involvement in the South African apartheid regime. Further, the first ESG scorecard was created in 1999 by Innovest, a research firm. In 2006, the United Nations created the Principles for Responsible Investment (PRI) report, which, for the first time, required ESG criteria to be incorporated in the financial evaluations of companies. That year, 63 investment companies (asset owners, asset managers, service providers) signed with $6.5 trillion in AUM incorporating ESG issues. In June 2019, the number of signatories grew to 2,450, representing over $80 trillion in AUM. Figure 2 shows this growth in companies that have joined the PRI report.

Figure 2: Signatories and AUM of the UN’s PRI report members over time

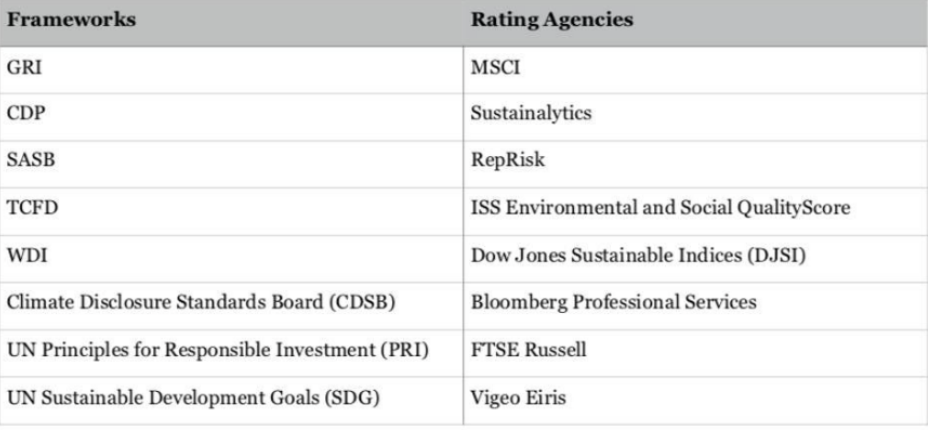

Today, there are tons of different ESG frameworks and rating agencies. The most common is the Global Reporting Initiative (GRI), an international independent standards organization that helps businesses, governments, and other organizations understand and communicate their impacts on ESG issues. 82% of the world’s largest 250 corporations report with GRI Standards. Figure 3 displays the world’s leading ESG frameworks and rating agencies.

ESG rating systems tend to be either industry-specific or industry-agnostic. Industry-specific scoring systems assess issues specific to the industry at large, while industry-agnostic ESG scores incorporate widely accepted factors that are meaningful across all industries.

Fortunately, ESG scoring has helped ESG-oriented companies from a financial viewpoint. An Oxford University report found that in the vast majority (88%) of companies that focused on sustainability, operational performance improved, translating to higher cash flows. In addition to helping solve the world’s most pressing issues while achieving a higher stock price, a strong ESG score can lead to increased benefits for employees and a healthier company. An increase in an ESG score correlates with increases in innovation, productivity and profitability. This is because companies with a strong ESG score foster more engaging employees who are more inclined to take risks and innovate. Companies like Apple, Microsoft, and Oracle have experienced this.

Consumers have won with ESG-oriented companies too. A Business Wire survey found that 68% of respondents said that implementation of ESG criteria aided in improved returns, along with 77% of respondents that said they invested in ESG strategies due to their impact on a public company’s financial performance. Ultimately, ESG criteria have turned out to be incredibly valuable, with ESG portfolios continually outperforming traditional portfolios.

However, the overarching question remains: How long will this trend last? Ultimately, it’s up to companies to implement sustainable business practices and for consumers to support them, regardless of financial benefits. The financial benefits we’ve seen thus far are due to the fact that progressively more people are willing to pay more for sustainable products. This is called a “green premium.” It is vital that more people pay green premiums so that sustainable products that are expensive can level out with cheaper, non-sustainable alternatives in the future. Ultimately, the future of ESG, industries, and our planet depends on where people hold this stuff ethically.

Sources

1. https://www.esgthereport.com/what-is-an-esg-score/

2. https://www.oecd.org/finance/esg-investing-environmental-pillar-scoring-and-reporting.pdf

3. https://www.forbes.com/sites/betsyatkins/2020/06/08/demystifying-esgits-history–current-status/ ?sh=2fbf1a6d2cdd

4. https://pro.bloomberglaw.com/brief/comparison-of-esg-reporting-frameworks/#:~:text=GRI%20is %20the%20most%20widely,in%20accordance%20with%20GRI%20Standards.

5. https://simplysustainable.com/insights/why-esg-ratings-matter-and-how-companies-use-them

6. https://corporatefinanceinstitute.com/resources/esg/esg-score/

7. https://corpgov.law.harvard.edu/2022/08/24/esg-ratings-a-compass-without-direction/

8. https://www.investors.com/news/esg-companies-list-2021-best-esg-stocks-environmental-social-governance-values-2/