By Sofia Tomljanovic, ESG McGill Analyst

How do cryptocurrencies work?

Have you ever heard of people investing in “crypto”? This almost ungraspable concept has spread everywhere in the world. It was invented in 2009 when the anonymous group Satoshi Nakamoto created and launched Bitcoin, the first cryptocurrency, in response to the 2008 Great Recession. Unlike regular currencies, Bitcoin is decentralized, meaning intermediaries like banks or governments do not validate it.

Bitcoin relies on Blockchain technology. With the algorithm SHA-256, cryptographic hash puzzles are mathematically solved to create blocks of information that, when validated, are unmodifiable, irreproducible and organized in chains to maintain the validity of the coins. Together, all these chains form the blockchain, or Merkle tree, that communicates to validate and keep a record of all transactions.

Every time the “miner” or puzzle solver achieves a block, they are rewarded with bitcoins. Right now, 6.25 bitcoins are released into circulation per block solved. However, the number of bitcoins is limited to 21 million, and the bitcoin rewards halve, meaning every 210,000 blocks solved, for roughly four years, the number of bitcoins received per block halves. This is why when Bitcoin was released, 50 bitcoins were given in reward per block solved compared to 6.25 today, and so on until it becomes 0 and there are no bitcoins left to be mined.

Its creators set these characteristics to maintain scarcity and control inflation so that early bitcoins keep their value. It is expected that in 2140, all blocks will be mined, and thus all 21 million bitcoins will be released, at which time profit would only be made from transaction fees in exchanges. Presently, almost 19 million have been mined.

Although Bitcoin remains the most valuable cryptocurrency, there are thousands of digital currencies, such as Ethereum, that work in the same manner. Three ways exist to profit off of them: firstly and most famously by trading on the exchange market and awaiting growth in the coin’s value or demand, secondly by using it or accepting it as a form of payment for goods and services, and thirdly by mining the coins with special hardware and software that solve the puzzles. For Bitcoin, puzzles are solved in an average of 10 minutes.

Similarly, you may have heard of NFTs or non-fungible tokens, which are digital images encoded using Blockchain technology to keep track of transactions and owners like trademarks. These images are “minted” by their creators, just like bitcoins are released into circulation and safely exchanged in the market without being reproduced, thanks to blockchain technology. Most NFTs can only be bought with cryptocurrencies.

Currently, a single Bitcoin is worth CAD$ 49,600 (~26,000 as of August 31, 2022), while in 2011, the same coin was valued at US$1. Moreover, roughly 106 million people worldwide own a form of cryptocurrency; of this group, about 0.1–0.2% own NFTs. The numbers are expected to grow, as is the market, but is this sustainable? A system can be sustainable in that it is prosperous economically, but if it isn’t sustainable at the ecological level because it increases the speed at which we extinguish nature, then it doesn’t matter how much money it makes or how much it will stay on top of trends, it is at its core self-destructing.

Let’s take a look at cryptocurrency’s ecological impact.

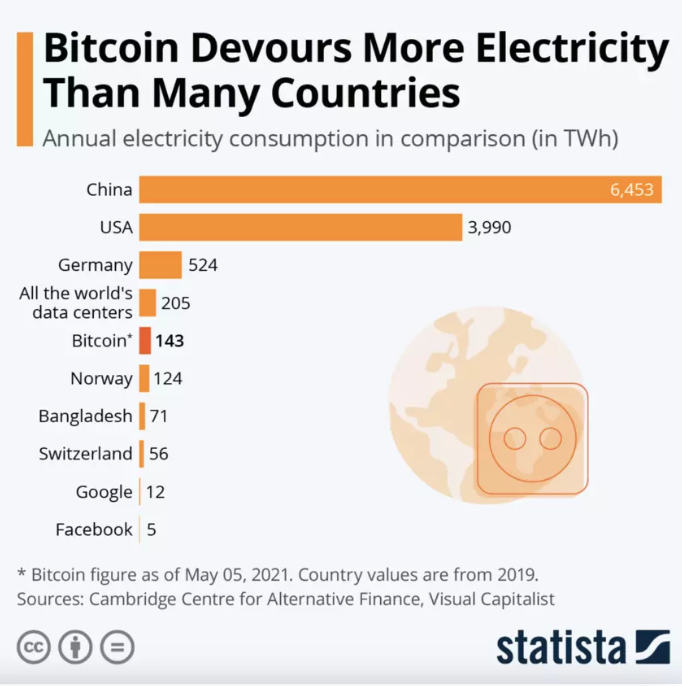

Because of the complexity that allows them to maintain a decentralized nature, cryptocurrency mining and transactions use an immense amount of energy. According to Columbia University’s Climate School, “Globally, Bitcoin’s power consumption has dire implications for climate change and achieving the goals of the Paris Accord because it translates into an estimated 22 to 22.9 million metric tons of CO2 emissions each year — equivalent to the CO2 emissions from the energy use of 2.6 to 2.7 billion homes for one year. One study warned that Bitcoin could push global warming beyond 2°C. Another estimated that bitcoin mining in China alone could generate 130 million metric tons of CO2 by 2024.” Furthermore, they share that “while it’s impossible to know exactly how much electricity Bitcoin uses because different computers and cooling systems have varying levels of energy efficiency, a University of Cambridge analysis estimated that bitcoin mining consumes 121.36 terawatt hours a year. This is more than all of Argentina consumes, or more than the combined consumption of Google, Apple, Facebook and Microsoft.” The energy consumption of this currency is problematic and dangerous. While some choose to stay optimistic about the transition into renewable energy sources, we must thoroughly analyze how this would work before looking away.

Renewable energy and cryptocurrencies.

Right now, cryptocurrency relies mostly on fossil fuels, which is why Tesla backed out from accepting Bitcoin as payment, hoping to go forward with this project when renewable energy is used for at least 50% of mining activities. More and more companies, governments and banks are becoming more interested in or already own reserves and exchange digital currencies, yet restrictions have been placed in 42 countries surrounding the flow of these. Moreover, all forms of cryptocurrency became illegal in eight countries, namely in China which banned it completely as of June 2021, fearing unethical aspects like fraud, money laundering and pollution. Miners have pushed away from a large amount of hydro energy available in the country that used to put the total renewable energy resources used for crypto at about 42%, which dropped to 25% after the ban in August of 2021. Instead, they moved to Kazakhstan’s coal and the United States’ natural gas. However, the search and use of renewable energy for cryptocurrency are on the rise today.

Unfortunately, hydro energy can greatly pollute the ecosystems in the rivers that provide it. The water is contaminated when flowing through the hydro dams or when it lies in the hydroelectric reservoirs, hurting wildlife nearby. Moreover, the excessive amount of renewable energy needed for digital coin production facilities could still be problematic because many other sectors, such as households’ heating and electricity and electric cars, need them. Infrastructures and money that could be used for these necessities would instead be used for cryptocurrency.

What’s more discouraging, Renee Cho mentions in her article Bitcoin’s Impacts on Climate and the Environment that “even if it one day becomes possible to run all bitcoin mining on renewable energy, its e-waste problem remains. To be competitive, miners want the most efficient hardware capable of processing the most computations per unit of energy. This specialized hardware becomes obsolete every 1.5 years and can’t be reprogrammed to do anything else. It’s estimated that the Bitcoin network generates 11.5 kilotons of e-waste each year, adding to our already huge e-waste problem.”

It is hard to wrap our heads around this complex issue that combines people, technology, economy, government, banks, energy and the future. Will it be worth it to spend our renewable energy resources on cryptocurrencies? Will mining hardware be made with sustainably disposable and responsible materials? Will this practice collapse, or will it adjust? Like many other ecological dilemmas, these are hard to answer, but they must be responsibly looked at and dealt with. We need to think many times before making investments if we want to preserve nature.